We stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one another. Our nearby future is all about Artificial Intelligence, a fusion of technologies that automate our routine business as well as life activities. Companies and organizations have started exploring and implementing the importance and benefits of AI in various fields of our life. Banking is one of the important and vast sectors that directly links in our daily life.

And when it comes to the banking sector, bulk amounts of check processing is a complex functionality. But what if we say that it can be easily automated and streamlined by using ML and AI technology!

Interested in knowing how to automate your check and payment processing?

You are at the right place! Read ON!

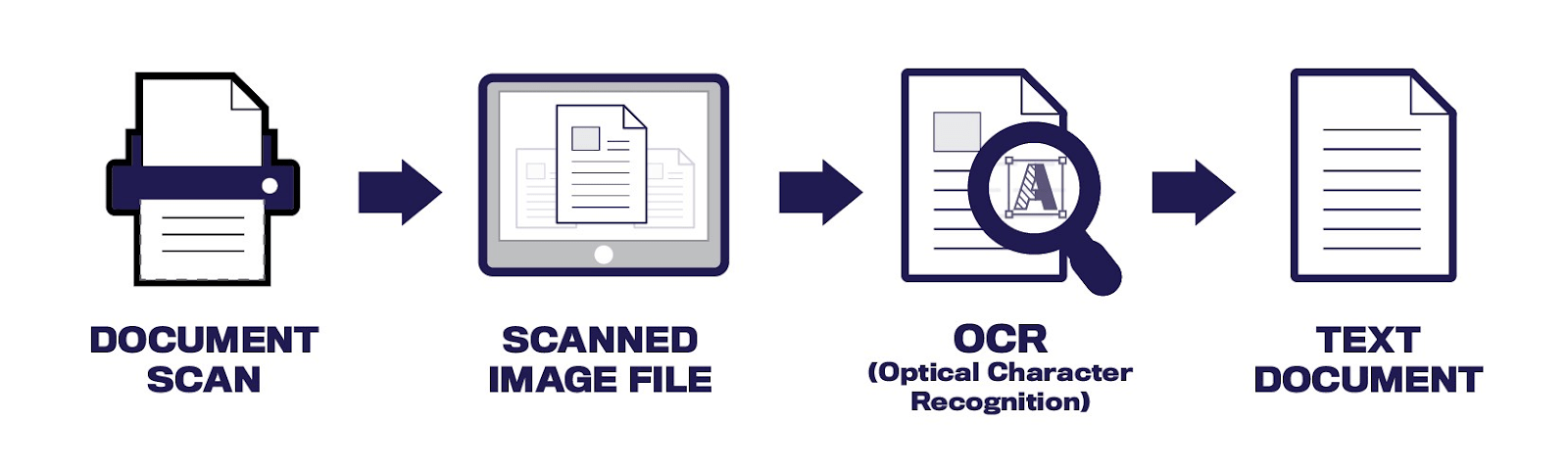

Despite the location and situation, users can now validate their cheques using our OCR Check processing technique. Also, using this technology, companies and organizations can validate bulk cheques and avoid cheque fraudulent in their business. By means of the OCR Check processing technology, the incoming cheques can be processed, validated, and deposited within a matter of seconds. For check processing with OCR software, all we need is an installed OCR software recognition cheque deposit application.

Working Methodology

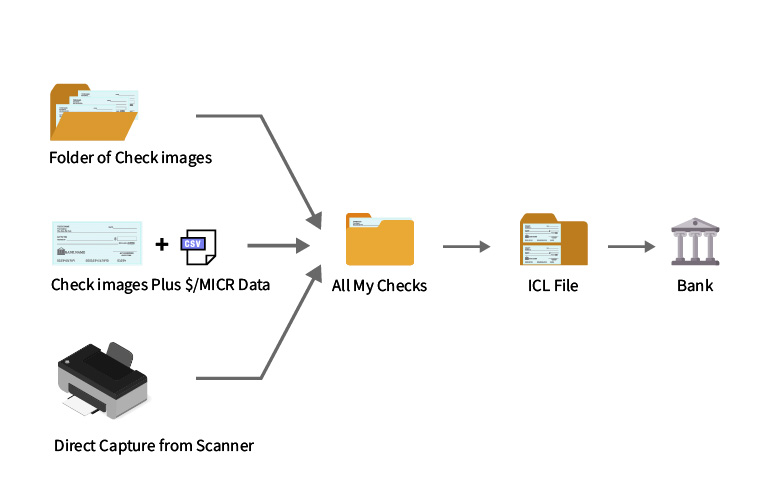

Initially, the user has to install the required OCR recognition software cheque deposit application which will be integrated with the bank servers. Later, the user has to upload the printed and handwritten cheque images. That’s all required from the user’s end, the rest of the validation process will be automatically processed by the application itself by means of scripted OCR and AI algorithms.

A cheque consists of various credentials such as

- Account number,

- Date,

- Signature,

- Bank details, etc., which are recognized by the MICR (magnetic ink character recognition) technology. This process uses ink with magnetic resonance to print characters on the bottom of each cheque indicating the routing and transit (R/T) numbers of the clearing bank, the account number on which the cheque is drawn, and the cheque number.

Later, by means of OCR technology (Optical Character Recognition Technology), the essential information inscribed in the magnetic ink will be processed. The processed information in the captured image will be recognized by the printed text present in the cheque image by means of OCR technology and further, it gets extracted and results in the creation of JSON text searchable files. Computer vision technology matches the signature credentials and cross verifies it in both captured image and signed document.

Artificial Intelligence and machine learning comes into play while processing and comparing with the documents since numbers and signatures on cheque are often handwritten which is not 100% accurate all the time due to the quality of the scanned cheque (in dpi) and the dimension/positioning of the cheque.

Thus, OCR Check Deposit Recognition system is complemented with the ICR technology (Intelligent Character Recognition) through which accurate details from various handwritten characters (both front and back side of the cheque) can be obtained at ease. It will also validate the value and the amount of words entered in the cheque.

Additional Post-processing modules are developed and used in order to improve the recognition accuracy rate from the captured images. Thus, by providing the captured images of both sides of the check, OCR name and amount, the user can validate the cheque within a matter of seconds and receive the deposit confirmation.

Are you in need of an advanced technology solution to validate bulk amounts of cheques?

Simplify your complications within a matter of seconds!

Limitations of normal OCR Methodology

- Difficulty in controlling image acquisition physical environment, such as lighting, Camera performance and shooting angle

- Complications due to handwritten cheque signatures when it comes to payment processing solutions

Benefits of OCR Check Deposit Recognition System

- Check fraudulent identification within a matter of seconds

- Bulk cheque processing can be validated at ease

- Overcome cheque fraudulent at ease

- Provide instant feedback to your customers

- Avoid traditional wait times for deposit availability

Overcome the above challenges by implementing the OCR Cheque Recognition Application with ICR technology (Intelligent Character Recognition) to gain more accuracy to process the cheque validation.

PPTS India Pvt Ltd as an advanced technology solution provider helps in automating your cheque processing system. With our 19+ years of IT/ITES experience, we have rendered our unique technological solutions to various business complications and market requirements.